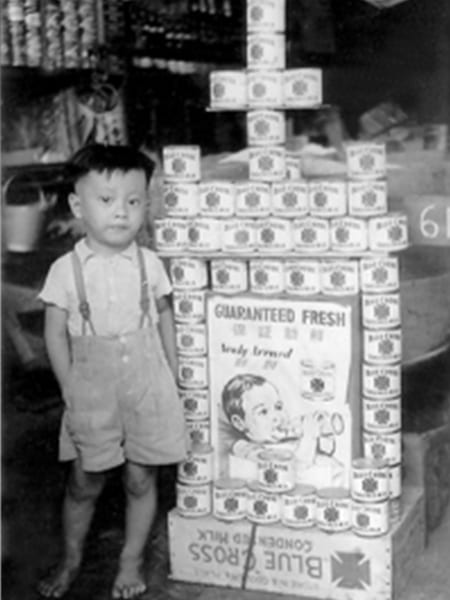

After World War II ended in 1945, Wilbur-Ellis was one of the first Western companies to return to Japan with an office reestablished in 1950 – a presence that continues today.

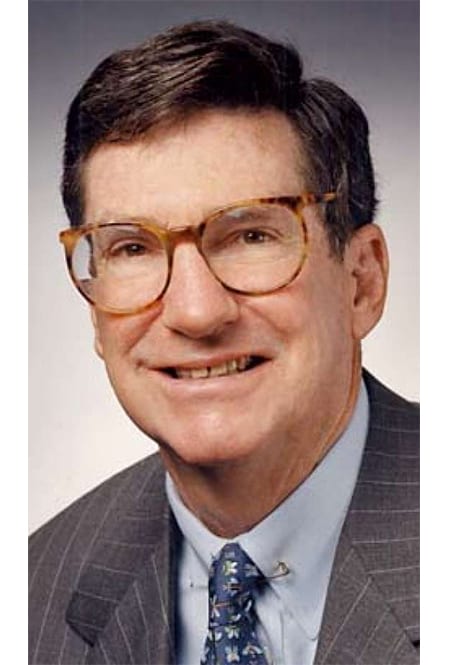

The same was true after the Korean War, which continued from 1950 to 1953. In 1954, Wilbur-Ellis returned to Korea, “a country that had been absolutely devastated by the war,” said John Thacher, current Executive Chairman of the Wilbur-Ellis Board of Directors and former company CEO.

In fact, throughout Asia, Connell established over a dozen offices strategically located in the Pacific Rim’s financial and commercial centers. Along with Japan and Korea, this included Guam and Taiwan.

Further south in Africa, Wilbur-Ellis started a fish meal trading business in South Africa, doing business with European and Japanese importers. This business grew into a more diversified operation, including the export of fishing nets, rope, sports gear, foodstuffs and novelties.

The company’s entry into South Africa had an unusual beginning. It was the result of a trip Brayton Wilbur Sr. made in 1948 as a member of a scientific mission to the country. He traveled with representatives from the Museum of Natural History in Nairobi, Kenya, who conducted zoological and anthropological studies in Africa.

But as an astute businessman, when Wilbur learned about the growing fishing industry in South Africa – and that the pilchard and jack mackerel were in abundant supply – he knew there were opportunities for Wilbur-Ellis. This was especially important since the pilchard (or Pacific sardine) had disappeared in commercial quantities from Northern California waters, never to return.

Soon after his visit, an office was opened in Cape Town, South Africa, and two years later Wilbur-Ellis was appointed the exclusive sales agent in the U.S. by the South African Fish Meal Producers Association. Over the years, the office grew and became more diversified in the products it traded, but always maintained close ties with the fishing industry.

All these achievements made the 1950s a period of rapid growth for Wilbur-Ellis. Just as U.S. and global markets were expanding after World War II, Wilbur-Ellis was pursuing new opportunities and making hard choices about leaving certain businesses.

But even as Wilbur-Ellis grew and changed, its basic beliefs remained the same. In the conclusion of his speech, Brayton Wilbur Jr. reiterated the philosophy of the company’s founders:

“Wilbur-Ellis’ strong position is the result of a basic belief that the responsibility of this company is to our customers and to the integrity of our contracts. We provide what we promise. As with all successful companies, profitability is essential, for without it there is no company. But we believe that profitability comes when we are responsible to our customers, our employees, our business partners, and the communities in which we live.”

“Growing up, I heard that philosophy many times,” said Mike Wilbur, son of Brayton Wilbur Jr., and now President and CEO of Cavallo Ventures, the investment arm of Wilbur-Ellis, and a member of the Wilbur-Ellis Board of Directors.